Table Of Contents

Providing Evidence of Damage

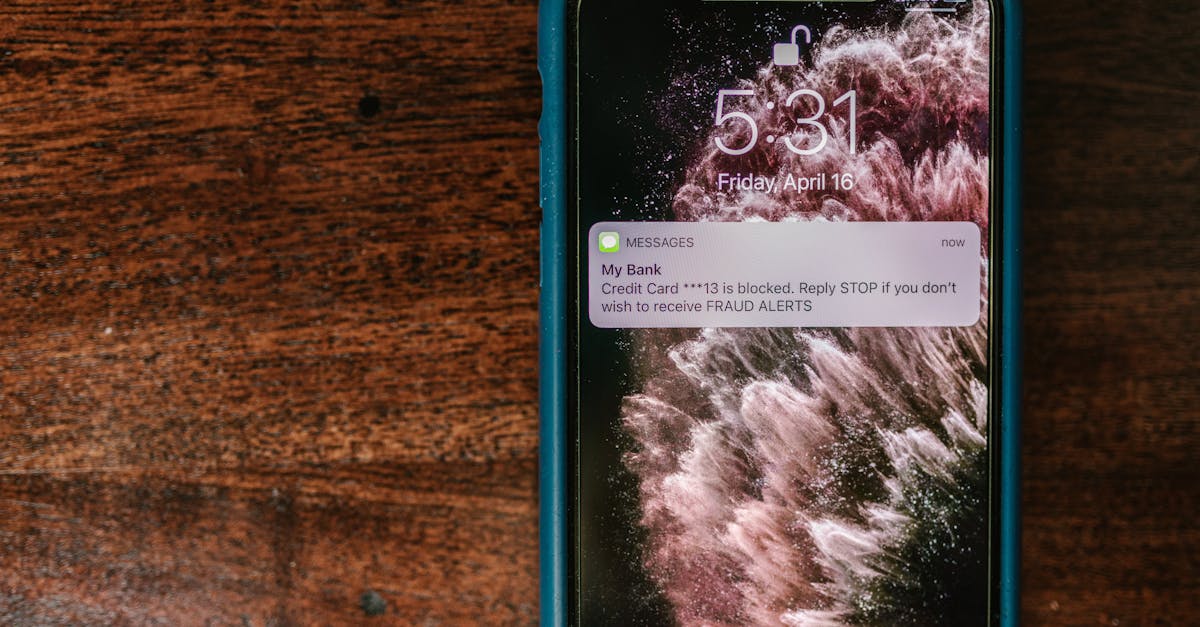

When filing a water leak insurance claim, it is crucial to provide substantial evidence of the damage. Start by documenting the affected areas thoroughly, capturing high-quality photographs that clearly show the extent of the issues. Details matter; include images of any damaged property and the source of the leak. Be sure to keep all related receipts and invoices, especially those for burst pipe repair. This documentation serves as proof of repairs and maintenance, reinforcing the legitimacy of your claim.

Additionally, ensure you prepare a comprehensive list of all items damaged due to the leak. Including the original purchase dates and costs will significantly strengthen your case. This level of detail helps your insurance adjuster understand the situation better. If you have obtained quotes for repairs or replacements tied to the incident, include those as well. A well-organized presentation of evidence can facilitate a smoother claims process and aid in demonstrating the necessity of your claim.

Importance of photographs and receipts

Taking photographs immediately after discovering water damage is crucial for a robust insurance claim. Clear images of the affected areas will serve as visual evidence, helping adjusters understand the extent of the damage. Additionally, capturing close-ups of items damaged by water can reinforce the need for a burst pipe repair. These photographs should be time-stamped to establish a timeline for the occurrence, making them even more valuable.

Receipts also play a significant role in substantiating your claim. Gathering and maintaining records of expenses related to repairs or temporary accommodations demonstrates the financial impact of the damage. For instance, keeping receipts for any burst pipe repair services or materials used can help convey the necessity of your claim. Both photographs and receipts create a compelling narrative that supports your case and expedites the processing of your claim.

Working with Adjusters

When working with adjusters, clear communication is vital. They are responsible for assessing the damage and determining the amount covered under your policy. Prepare to provide detailed information about your claim, including documentation related to the burst pipe repair. Organizing records, such as previous maintenance and related correspondence, can expedite the evaluation process.

Adjusters will often conduct thorough assessments of the property and the damage caused by the leak. Their findings can directly impact the compensation you receive. Be ready to discuss any preventative measures you took prior to the incident and how you addressed the burst pipe repair. Demonstrating your proactive approach can help strengthen your case and potentially lead to a more favorable outcome.

What to expect during the assessment

During the assessment process, expect an insurance adjuster to visit your property to evaluate the extent of the damage caused by the water leak. They will examine the affected areas, noting the specific issues related to your claim. Be prepared to discuss the circumstances that led to the damage, highlighting any pertinent details, such as when you first noticed the leak and when repairs were initiated. The adjuster's assessment will help determine the scope of coverage and the amount you may be eligible to receive.

The adjuster will also look for supporting documentation, including receipts for repairs and notes from professionals involved in the burst pipe repair. This can include plumbers or contractors who addressed the initial problem. Providing thorough and organized records can facilitate a smoother evaluation. Be honest and straightforward during the assessment, as this will help establish credibility and potentially expedite your claim's processing.

Potential Challenges in the Process

Navigating the insurance claim process for water damage can present several challenges. One common issue is the ambiguity surrounding repair costs. Insurers may dispute the estimated expenses for essential services like burst pipe repair, leading to delays in claim approvals. Claimants often find themselves needing to provide extensive documentation to justify their requests, which can add to their stress during an already difficult time.

Another hurdle involves communication with the insurance company. Policyholders might receive inconsistent information from different representatives, creating confusion about coverage and next steps. This uncertainty can prolong the overall process, especially when urgent repairs are needed to prevent further damage. Understanding the specific terms of the policy plays a crucial role in minimizing these potential hurdles, allowing for more effective communication when dealing with claims.

Common reasons for claim denials

Claim denials can stem from various reasons, often leading to frustration for policyholders. One common issue arises from insufficient documentation. Insurers require clear evidence of the damage and associated costs. If the policyholder fails to provide adequate photographs, receipts, or estimates, it may result in a denial. Additionally, if the cause of the water leak, such as a burst pipe repair, falls outside the policy coverage, the claim is likely to be rejected.

Another frequent reason for claim denials involves policy exclusions. Many insurance policies have specific conditions regarding maintenance and wear and tear. If an insurer determines that negligence or lack of proper maintenance led to the leak, like failing to address ongoing issues with a burst pipe repair, they may deny the claim. Understanding the details of the policy can aid in avoiding these pitfalls and improving chances of approval.

FAQS

What should I do first if I discover a water leak in my home?

The first step is to stop the source of the leak if it is safe to do so. Then, document the damage and contact your insurance provider to report the claim.

How important are photographs when making a claim for water damage?

Photographs are crucial as they provide visual evidence of the damage. They help support your claim and demonstrate the extent of the damage to the insurance adjuster.

What types of receipts should I keep when dealing with a water leak claim?

Keep receipts for any repairs, temporary fixes, or emergency services you hire to address the leak. These documents can substantiate your claim and the costs incurred.

How long does the insurance claim process typically take for a water leak?

The duration of the claim process can vary depending on the complexity of the case and the insurance company’s procedures. It may take anywhere from a few days to several weeks.

What are some common reasons for insurance claim denials related to water leaks?

Common reasons for denial include lack of proper documentation, not reporting the claim promptly, or failure to maintain the property adequately, which can be considered negligence.