Table Of Contents

Importance of Documentation

Documentation plays a crucial role in the process of filing an insurance claim for failed waterproofing. Homeowners should keep detailed records of any incidents, including photographs of damage and notes about when and how the issue occurred. An organized file that includes receipts for burst pipe repairs and related expenses can provide strong evidence supporting the claim. Proper documentation ensures that all relevant information is readily available, making it easier for both the homeowner and the insurance adjuster to assess the situation.

Additionally, documentation can help clarify the extent of the damage and the effectiveness of previous maintenance efforts. Keeping maintenance logs and records of repairs made, such as burst pipe repair, can demonstrate a proactive approach to home care. When insurance companies receive comprehensive documentation, it simplifies the review process and might influence the outcome of the claim favorably. The more information provided, the better the chances of securing appropriate coverage following a waterproofing failure.

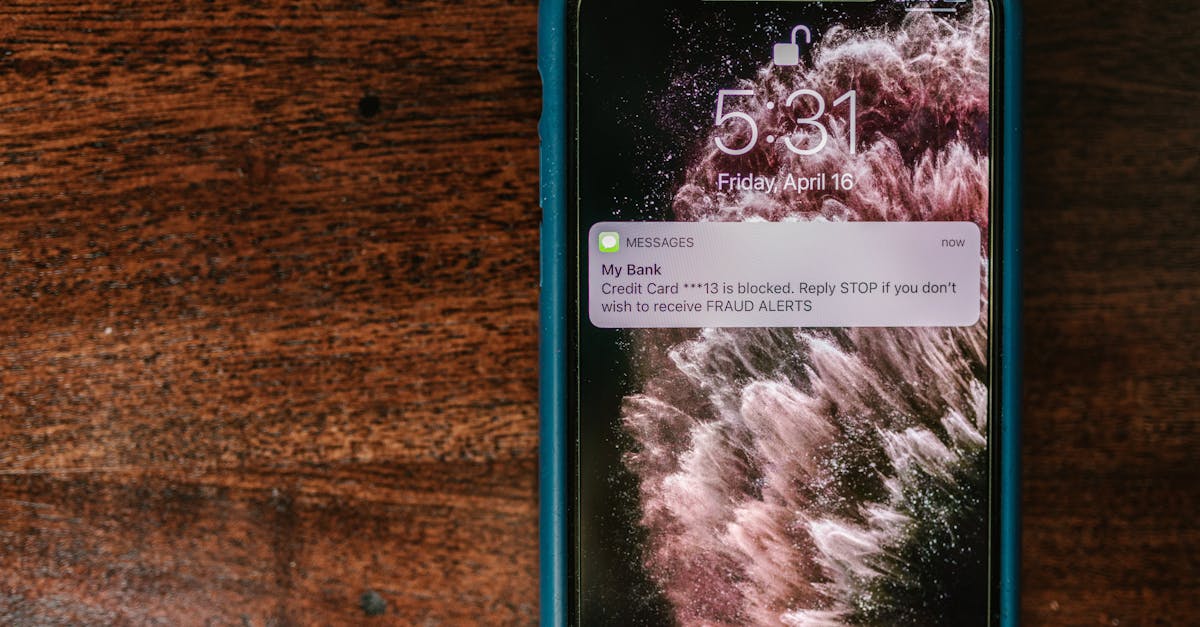

Gathering Evidence for Your Claim

Collecting comprehensive evidence is essential when filing an insurance claim for failed waterproofing. Documentation should include photographs of the damage, claims of previous maintenance, and any relevant repair invoices. If the damage resulted from a burst pipe repair, having records of the plumbing work can be particularly beneficial. This information supports your claim and establishes a timeline that insurance adjusters can use to assess the situation.

In addition to photographs and invoices, written statements from contractors or plumbing professionals can add credibility to your case. These experts can explain the cause of the damage, particularly if it stems from faulty waterproofing or inadequate maintenance. Their insights help build a stronger argument for why your claim should be honored and provide context that may sway insurance companies to view your situation favorably.

Exclusions in Insurance Policies

Homeowners often overlook specific exclusions in their insurance policies regarding water damage. Standard policies may not cover instances where the damage results from lack of maintenance or wear and tear over time. If a homeowner experiences water penetration that leads to significant damage due to a failure to maintain waterproofing systems, the insurer may deny the claim. Understanding these exclusions is crucial for policyholders hoping to navigate potential claims effectively.

In some cases, insurance policies may cover incidents like burst pipe repair, but this coverage might be limited to specific scenarios. For example, if a pipe bursts due to freezing conditions and the homeowner has taken reasonable preventive measures, repairs might be covered. However, if the damage stems from an ongoing issue related to improper waterproofing or neglect, the claim could be rejected. Homeowners should read their policy details carefully to be aware of any potential gaps in coverage.

Specific Scenarios Where Coverage Might Be Denied

Insurance coverage can be denied in several specific scenarios related to waterproofing failures. One common situation occurs when the damage stems from neglect or lack of proper maintenance. Insurers often look for evidence that property owners have taken steps to prevent water intrusion. If a homeowner fails to address issues like a leaking roof or does not repair a burst pipe promptly, the insurance policy may not cover the resulting damages.

Another scenario involves pre-existing conditions that are known to the homeowner. Insurers typically require disclosure of prior issues, and if a property owner has previously experienced problems with waterproofing, coverage may be denied for subsequent claims. Furthermore, if an inspector notes ongoing deterioration that has not been addressed, such as an untreated leak or flawed burst pipe repair, the insurer may deem the homeowner responsible for the damages.

The Role of Inspections and Maintenance

Regular inspections and maintenance play a critical role in protecting your property from water damage. By identifying potential issues early, homeowners can make timely repairs, such as fixing leaks and ensuring appropriate waterproofing measures are in place. This proactive approach can significantly reduce the risk of extensive damage in the event of a water intrusion. For instance, scheduling routine check-ups can uncover vulnerabilities that may lead to costly repairs and complex insurance claims.

Failure to maintain a property can result in serious consequences when it comes to insurance coverage. Insurers often look for evidence of regular upkeep, as neglect can indicate a lack of responsibility. If a burst pipe repair is necessary and it is discovered that proper inspections were not routinely conducted, this could jeopardize a claim. Insurers may consider neglect as a reason to deny coverage, emphasizing the importance of regular maintenance.

How Regular Maintenance Can Prevent Claims

Regular maintenance of waterproofing systems can significantly reduce the likelihood of issues that lead to costly claims. Homeowners are advised to conduct routine inspections of their structures, particularly areas prone to water intrusion such as basements and exterior walls. Maintaining these systems not only involves checking for visible wear and tear but also ensuring drainage systems are functioning optimally. An effective maintenance routine can identify minor problems before they escalate, preventing potential water damage that could result from failures like a burst pipe repair.

Failure to maintain waterproofing systems can lead to increased risk of significant damage. Many insurance policies require homeowners to demonstrate that they have taken reasonable steps to maintain their property. Neglecting simple maintenance tasks might result in claims being denied, especially if water damage has resulted from lack of upkeep. Regular checks and prompt burst pipe repair are essential for safeguarding the integrity of your property and ensuring that you remain eligible for coverage under your insurance policy.

FAQS

Is failed waterproofing typically covered by home insurance?

Coverage for failed waterproofing can vary based on the insurance policy. Generally, it may not be covered if the failure is due to lack of maintenance or wear and tear.

What types of documentation should I gather for a waterproofing claim?

You should compile photographs of the damage, receipts for waterproofing services, inspection reports, and any correspondence with contractors or insurance representatives.

Are there specific scenarios where my insurance might deny a waterproofing claim?

Yes, claims may be denied if the damage results from neglect, improper installation, or if the policy specifically excludes water damage from certain sources.

How often should I have my waterproofing inspected to prevent issues?

It is recommended to have waterproofing systems inspected at least once a year or more frequently if you live in an area with heavy rainfall or flooding.

Can regular maintenance help in making a claim for waterproofing damage?

Yes, regular maintenance can demonstrate to your insurer that you have taken proactive steps to prevent damage, which may strengthen your claim if an issue arises.