Table Of Contents

The Role of Home Maintenance in Coverage

Home maintenance plays a crucial role in determining whether your insurance will cover repairs for incidents such as burst pipe repair. Regular inspections and prompt attention to potential plumbing issues can significantly reduce the risk of catastrophic pipe failures. Insurers often look for evidence that homeowners have maintained their property properly. Neglecting routine maintenance may lead to denied claims, as insurers might argue that lack of care contributed to the damage.

Keeping track of maintenance records can prove beneficial when filing a claim. If you can demonstrate that you made the necessary efforts to maintain your plumbing system, you enhance your chances of securing coverage for burst pipe repair. Simple actions, like clearing gutters and checking for leaks regularly, can safeguard against emergencies while also reflecting positively with your insurer. By maintaining your home diligently, you help establish a strong case for coverage in the event of a plumbing disaster.

How Preventive Measures Affect Claims

Homeowners who adopt preventive measures often find themselves in a better position when filing insurance claims for burst pipe repair. Regular maintenance tasks, such as inspecting plumbing systems, checking for leaks, and insulating pipes, can significantly reduce the likelihood of water damage. Insurers frequently appreciate these proactive steps, which can boost a homeowner's credibility during the claims process. When a policyholder demonstrates a commitment to upkeep, it can lead to smoother resolutions.

Moreover, maintaining a detailed record of preventive actions can be beneficial in the event of a claim. Documentation of repairs and installations serves as evidence that the homeowner has acted responsibly. If a claim arises due to a burst pipe, insurers may scrutinize whether adequate preventive measures were in place prior to the incident. This can influence not only the approval of the claim but also the overall handling of the situation, impacting both the financial outcome and the speed of the repair process.

Understanding Deductibles

Deductibles play a crucial role in how insurance claims are processed. When a homeowner experiences damage due to a burst pipe, the deductible is the amount they must pay out of pocket before the insurance policy kicks in to cover the remaining costs. Policies can vary significantly in terms of deductible amounts. Understanding this aspect of your insurance policy is essential for managing potential repair expenses.

For instance, if a homeowner has a low deductible, they may find it easier to access funds for burst pipe repair. Conversely, a higher deductible means more financial responsibility at the outset. This can impact the overall affordability of repairs along with the decision to file a claim. It's important to carefully assess the deductible in relation to the home’s value and potential risks to ensure adequate coverage.

Impact on Your OutofPocket Costs

The cost of repairing a burst pipe can vary significantly based on the type of damage and the location of the leak. If the repair falls under your homeowner's insurance, you may end up paying only your deductible, while the insurance policy covers the remaining expenses. However, if your claim is denied due to a lack of maintenance or coverage limitations, the entire cost of burst pipe repair will fall on you.

Understanding your deductible is crucial when assessing potential out-of-pocket costs for burst pipe repair. Higher deductibles can lead to lower premiums, but they may also mean a larger financial burden during a claim. Weighing these factors against the likelihood of experiencing a plumbing emergency can help you make informed choices about your insurance policy and maintenance practices.

Repairing Damages

Repairing damages caused by a burst pipe can be a significant financial burden for homeowners. Insurance coverage often depends on the specific details of the policy and the circumstances surrounding the incident. Some policies may cover burst pipe repair, especially if the damage resulted from sudden and accidental events. Homeowners should thoroughly review their policies to understand what is included and any potential exclusions related to water damage.

When considering the costs of burst pipe repair, homeowners should be aware of the possibility of out-of-pocket expenses. This consideration becomes crucial if the deductible amount is high, making it impractical to file a claim. Evaluating the total costs associated with the repair, including potential increases in insurance premiums, can help homeowners make informed decisions about whether to rely on insurance or pay for repairs directly. Understanding these financial implications is essential to managing the aftermath of a burst pipe.

Cost Comparisons and Considerations

When evaluating the costs associated with burst pipe repair, it’s essential to compare insurance coverage against out-of-pocket expenses. Homeowners should first check their insurance policy details to determine if their specific policy includes water damage from burst pipes. Understanding policy limits and exclusions plays a critical role in assessing potential financial responsibility.

Additionally, the scenario surrounding the burst pipe repair can significantly influence costs. Issues such as the severity of the damage, the location of the pipe, and the materials needed for repairs all contribute to the overall expense. Homeowners might find that, in some cases, paying for repairs out of pocket is more economical, especially when deductibles are factored in. Balancing these considerations is crucial for making an informed decision.

FAQS

Does homeowners insurance cover burst pipe repairs?

Homeowners insurance often covers burst pipe repairs, but coverage can vary based on the specific policy and the cause of the damage. It is essential to review your policy details and speak with your insurance provider to understand your coverage.

Are there any preventive measures I can take to avoid burst pipes?

Yes, regular home maintenance such as insulating pipes, keeping the home heated during cold weather, and routinely checking for leaks can help prevent burst pipes and potential damage.

How does my deductible affect my insurance claim for a burst pipe?

Your deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. If the cost of repairing the burst pipe is less than your deductible, you may not benefit from filing a claim.

Should I repair burst pipes myself or hire a professional?

While minor repairs may be manageable, it is generally advisable to hire a professional plumber for significant issues like burst pipes. This ensures proper repairs and documentation for insurance claims.

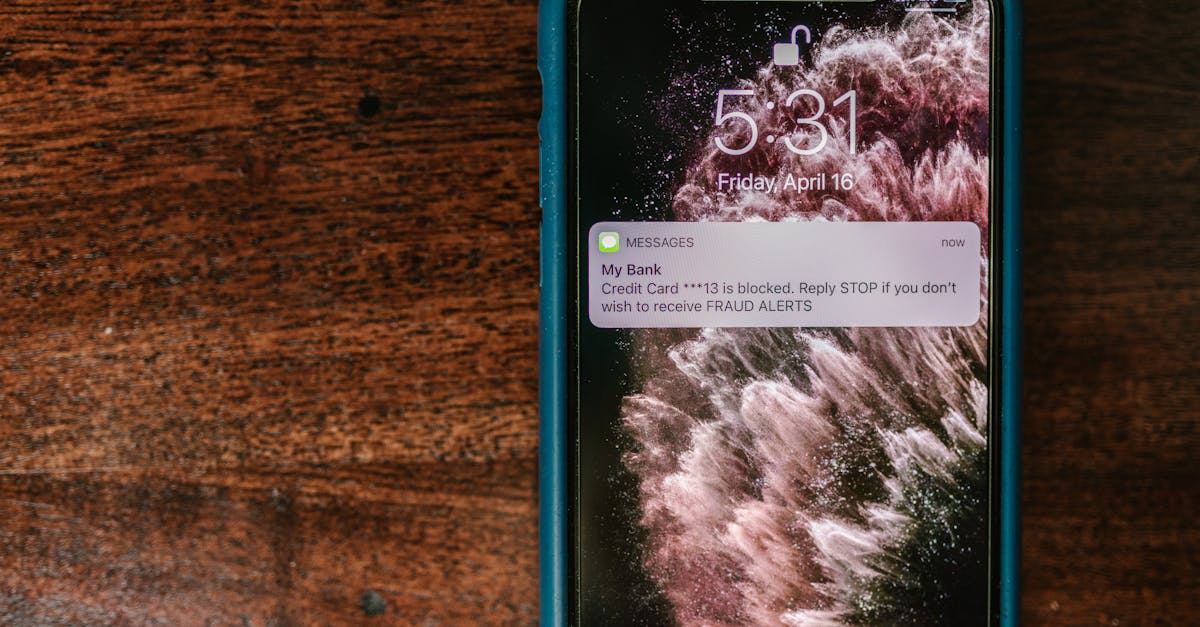

What should I do if my insurance claim for burst pipe damage is denied?

If your claim is denied, review the denial letter for specific reasons, gather any relevant documentation, and contact your insurance provider to discuss the denial. You may also consider appealing the decision or seeking advice from an insurance expert.